Drinkers across the UK let out a collective sigh this Autumn. The latest figures from the British Beer and Pub Association (BBPA) had revealed that for the second successive time since first occurring in 2014, more beer was being consumed in the off-trade than the on-trade. A sign of the transitory drinking landscape, changing habits and developing tastebuds, people increasingly chose to drink their beer away from the familiar confines of the UK’s 145,000 pubs, bars and restaurants.

Some saw this as further indication of the decline of our pub culture, with 3,000 fewer pubs in operation than 2012. Some cite the increased prevalence of cheap availability of beer in supermarkets, while others would acknowledge that the beer they want just isn’t readily available in pubs.

Looking at volumes, the equivalent of 44m hectolitres of beer were sold last year. The majority of this (51%) away from the on-trade. With a focus on cost, the average pub price of a pint of lager on draught came in between £2.40 and £4.70, nearly 40% (38%) more than a decade previous. A pint of bitter experienced a similar increase to between £2.05 and £3.90.

According to the BBPA’s Annual Statistical Handbook 2016, alcohol consumption across the UK remained broadly flat, with some countries, including the UK, witnessing declines in per-head consumption. Estonia, Luxembourg and the Czech Republic consumed the most alcohol per head of population.

UK beer consumption of 67.7 litres of beer per head is below the EU average of around 72 litres per head, per year. Focusing on UK beer duty, it is 54% higher than it was in 2000, despite the recent cuts to the duty rate. The BBPA explains the data demonstrates that much more work needs to be done to cut beer duty in the UK, with the UK rate still “a staggering” 14 times that of Germany.

So drinkers are consuming more of their beer through small-pack vessels and cans continue to increase in popularity among breweries and consumers alike. Something mirrored in many other geographies, too.

A report on recent beer trends in our Canadian sister publication, Brewers Journal Canada, demonstrated that the percentage of beer sold in bottle declined 3.7% to 35.4% last year. It continued a downwards trend that has dipped by an average of 4% each year since 2010 (the start of the record in this case). Canned beer has enjoyed the opposite in this instance, increasing its prominence in the field by 3-4% each year, jumping from 51.1% to 54.7% between 2014 and 2015. Draught beer accounts for 9.9% of beer sales, the same as 2014 and a 0.5% increase since 2010.

Moving back to the UK, Rob Lovatt, head brewer at Thornbridge nailed its colours to the bottling mast this year with the installation of a brand new KHS Filler.

“We had numerous options on the table, including a cheaper machine, a less dramatic jump in capacity of the new filler and the most contentious option, which was purchasing a canning line instead. In terms of the canning option, I have had even good friends in the industry question if this was the right decision to make,” he explained. “So while cans are fashionable and are easy to carry around, we have to do what is best for our beer, which is why we have decided to invest in the KHS Filler.”

He added: “It is the Rolls-Royce of bottling lines; its technology enables us to achieve extremely low levels of dissolved oxygen in the bottle, it will future proof the growth of the brewery and will prove to be an extremely robust piece of kit with greatly reduced downtime. The bottom line is that we are putting our beer first.

He added: “It is the Rolls-Royce of bottling lines; its technology enables us to achieve extremely low levels of dissolved oxygen in the bottle, it will future proof the growth of the brewery and will prove to be an extremely robust piece of kit with greatly reduced downtime. The bottom line is that we are putting our beer first.

“One thing we don’t do here is grow exponentially and then allow the beer quality catch up, so although we plan to install even more fermentation and maturation vessels this year, we will be able to keep up the consistency and quality for which we are known, and our famous maturation times will not be affected.”

On the other side of the coin, Paul Jones, co-founder of Cloudwater, recently detailed why the brewery was looking to make the significant transition to canning its beer.

He explained that Cloudwater took the plunge with its own bottling line several years ago as a way to ensure its beer could be an option at family dinners, weeknight BBQs, and the “beer sat in your fridge when you got home”. It also enabled them to support the growing number of bottle shops.

Research into entry-level canning lines at the time in 2014 instead led the brewery to invest in a Meheen M6 filler, installed and serviced by Oasthouse Engineering/Beer 2 Bottle.

He explained: “Since we commissioned our M6 in Spring 2015 we’ve filled nearly 400,000 bottles, and learned a lot about running a small packaging line in the process. We’ve gone from runs of 2000 bottles every once in a while, to runs of 7500, more than a couple of times a week, but we’ve hit the limits of our compact M6 with our expansion coming up, and have to look again at how we package beer in a way that lets us reach lots of consumers around the country with a great quality beer.

“Our biggest two issues with cans have always been how to protect such a large aperture from O2 and bacteria ingress during filling, and whether the agencies that qualify that the levels of BPA in can liners as safe can really be trusted. We had also never previously seen a canning line that we thought would put us in a better position than our M6 in terms of usability, reliability, or dissolved oxygen either.”

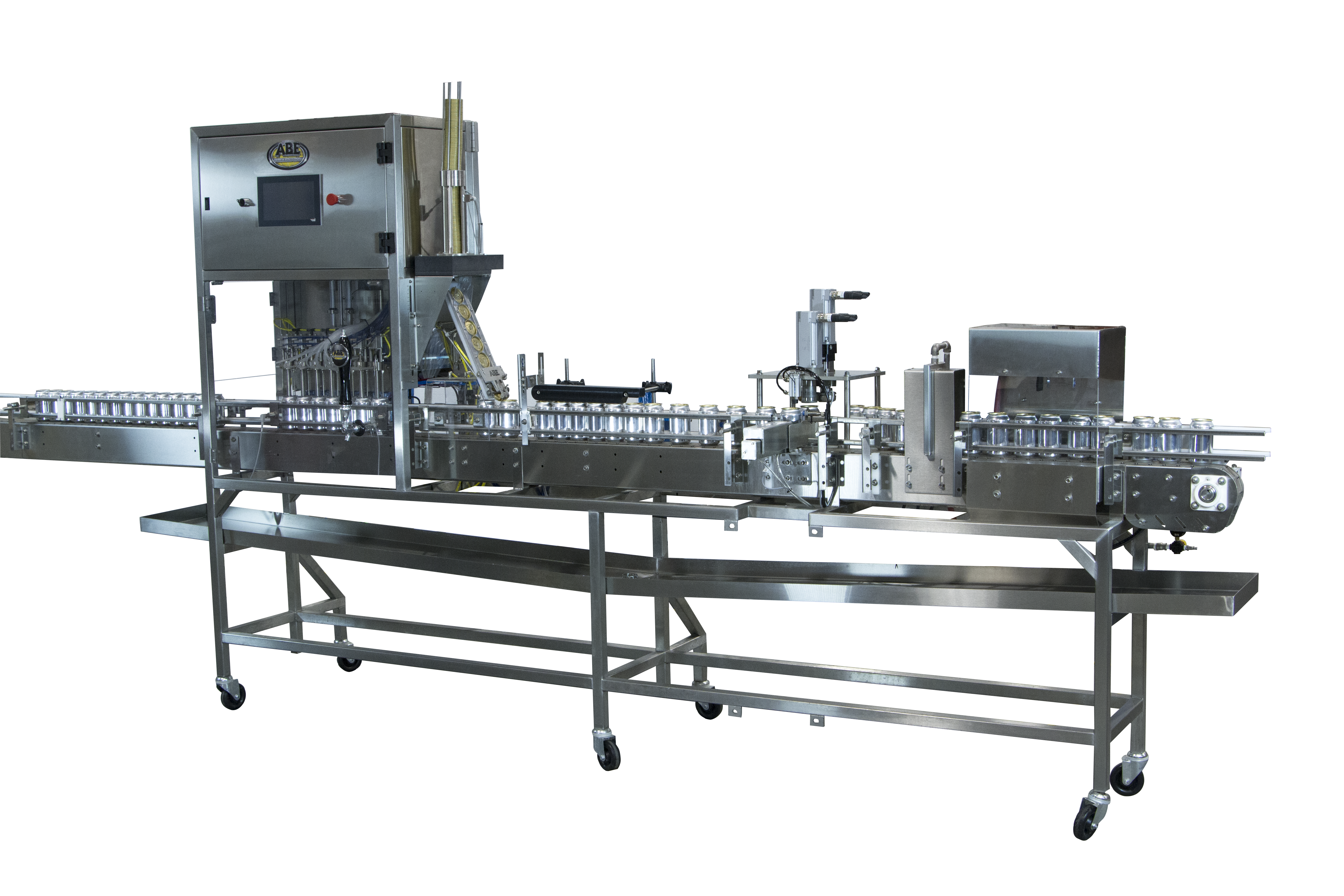

Jones allayed such fears of bacteria and O2 ingress after seeing an ABE LinCan 60 in action at Five Points in London.

“After the cans are filled they rapidly progress towards the can end chute, where each can receives a can end – the first can at under 2 seconds from the end of filling, and the last (eleventh can) in under 5 seconds from the end of the fill cycle,” said Jones. “Whilst there are concerns about BPA in can liners (in general, including food can liners), we’re increasingly confident that we’re not being mislead by any agency or manufacturer. As beer buyers ourselves, the liners have never put us off a purchase, or made us worry about our health.”

He further explained the company’s move.

“What’s also really exciting for us, is that we’ll get to package some beers into 500ml cans, and others into 330ml cans as we see fit, rather than having all our brite beer in just 330ml bottles as we do now,” he explained.

“There are other benefits to canning too: hermetical seals rather than vulnerable crown caps; half the box size and weight of bottles means half the cold store space and twice as much on each van delivery and pallet we ship; zero light striking effects; vastly improved portability; wider reach with cans readily accepted into music venues and festivals; near infinite recyclability; less cardboard use; lower environmental impact during can deliveries (pallets of empty cans weight very little) and shipments (full cans weight as little as 343g, where full bottles are around 650g).”

However, he added that it would be “remiss” not to mention that cans have some key disadvantages.

“Low acceptance in high end restaurants who are deeply averse to putting a can on their dining tables; poor tolerance of pressure (compared to bottles); and dissolved oxygen will continue to cause us concern until we regularly see the same readings we get from our little M6,” Jones concluded.

Sam Morris from Sheffield-based Oasthouse Engineering, which supplied Cloudwater’s Meheen line, says an increasing number of breweries are opting to can their beer but demand for bottling technology remains high at the business.

“Cans are not a threat to bottles, they are complementary. It’s an option and the industry is better for it. Cans are great as they obviously open up new avenues and sales channels for breweries but this is another route to growth for these businesses,” she explains. “As the on-trade continues to grow, bottles and cans offer that opportunity to breweries Small pack sales will continue to grow, alongside these breweries and that is a very good thing. It means you can drink beer from Põhjala in London and visit Tallinn and enjoy a Gamma Ray from Beavertown.”

According to Morris, companies such as Oasthouse Engineering work alongside breweries and form relationships with them rather than operating on a simple one-off sales basis.

“Even if you are an established brewery you are likely to need help and support. It’s rewarding to see breweries grow with a particular bottling line, then 12 months on, and return to discuss the next stage of their development. But if a company is opting for one system but claims it wants to treble production in the next 12 months, then it makes sense to invest in a more productive machine earlier on, where possible,” she says.

The starting point of the Meheen M2 filler the company offers starts at £28,000 for a standalone model with the option add to that with a labeller and other extras as required.

The starting point of the Meheen M2 filler the company offers starts at £28,000 for a standalone model with the option add to that with a labeller and other extras as required.

“You need to have the discussion where you ascertain what is essential and what is a wishlist. It’s about having that dialogue and working from there,” says Morris.

One brewery that recently opted for a Meheen line was Truro-based Skinner’s, a move that allows the company to meet growing demand for its core range of beers while bringing bottling in-house.

The investment allows Skinner’s to expand their distribution further outside the South West and create new jobs in the process.

Skinner’s founder, Steve Skinner, says its loyal customers were thrilled to know they can buy its bottled beer range nationally. “We’re responding to growing demand for the product – we’re currently bottling more than 100% than last year,” he explains.

Meheen offer 2, 4 and 6 head options. Its fillers are designed to meet a brewery’s specific production needs while multiple fillers can be integrated to further increase production, while protecting the company against the downtime risk associated with having a single, large filler.

Elsewhere, Marco Caralli, sales director at Framax, says while demand canning and kegging solutions continue to grow, the company is “incredibly busy” with its bottling lines that use a traditional isobaric multi-pre-evacuation system for glass or aluminium bottles and specific filling systems designed to fill beer into PET, cans and kegs.

Elsewhere, Marco Caralli, sales director at Framax, says while demand canning and kegging solutions continue to grow, the company is “incredibly busy” with its bottling lines that use a traditional isobaric multi-pre-evacuation system for glass or aluminium bottles and specific filling systems designed to fill beer into PET, cans and kegs.

“For many, bottling is the everyday bread and butter. It is as popular as ever and most people that do canning, still do bottling. It’s reliable as ever and you know what you are going to get,” he says.

He highlighted a dual investment at Redchurch and an imminent installation at Moncada as a sign of activity in London alone.

Despite offering both options, Caralli explains that he has a firm preference when it comes to beer.

“In my opinion, craft beer should be in a bottle. Like a bottle of wine, it shares that provenance, I think it just works better. It goes against a lot of popular opinion, of course, but that’s what I believe,” he adds.

Among the machines Framax offer are counter pressure filling systems. These feature various different types of filling valve designs, from the traditional mechanical counter-pressure valve that enables to carry out several phases such as pressurization, CO2 injection, multiple pre-evacuation, leveling and snifting, to the most sophisticated electro-pneumatic valve where all those same functions are completely controlled and programmable from the operator panel, allowing the most up-to date technology and flexibility which is necessary to obtain high quality results and reduced risk of contamination.

It also offers low vacuum-gravity filling systems for bottle-conditioned beers. The opening of the filling valves is given by the neck finish of the containers, lifted by the mechanical plates of the filler. Various models of filling valves are available within this category, specifically designed to cater for the filling level requirements, bottle shape, neck shape and product. Several optional features are available such as the “millimetric adjustment of the filling level” controlled directly from the user interface panel, air return outside the filling tank.

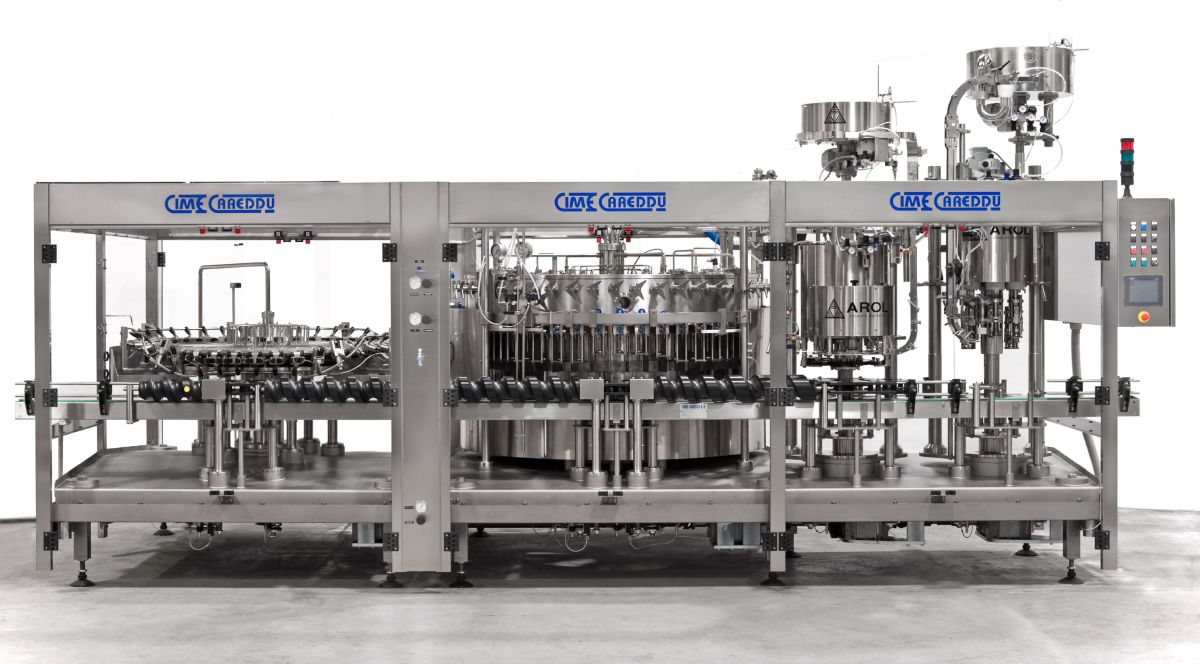

Jon Clatworthy is the commercial sales director at Vigo, which offers canning technology through American Beer Equipment (ABE) and bottling lines from CIMEC.

CIMEC lines offer functions that span filling, including counter pressure filling for carbonated products while bottles can be pre-evacuated to remove oxygen. They also offer corking and capping that can handle corks, ROPP caps, crown caps, and plastic screw caps.

He says that the company’s bottling clients tend to operate around the mid-hundreds to the 2,000 bottles an hour mark and that canning has not made the demand for bottling to fall off.

“There are many breweries that want to offer both, that’s understandable as it increases your route to market,” he explains.

On both fronts, Clatworthy says that Vigo’s customer base values what they call “non warranty time”.

He explains: “It’s a daunting task having new kit turn up, so we do all the commissioning and training with our own engineers. We then also offer several days where they can call up if there is any issue and rely on us to sort it. They know they have the time in the bank, and not be billed for it. “We have found that the likes of certain breweries’ experience with us has ensured that we have picked up business from word of mouth.”

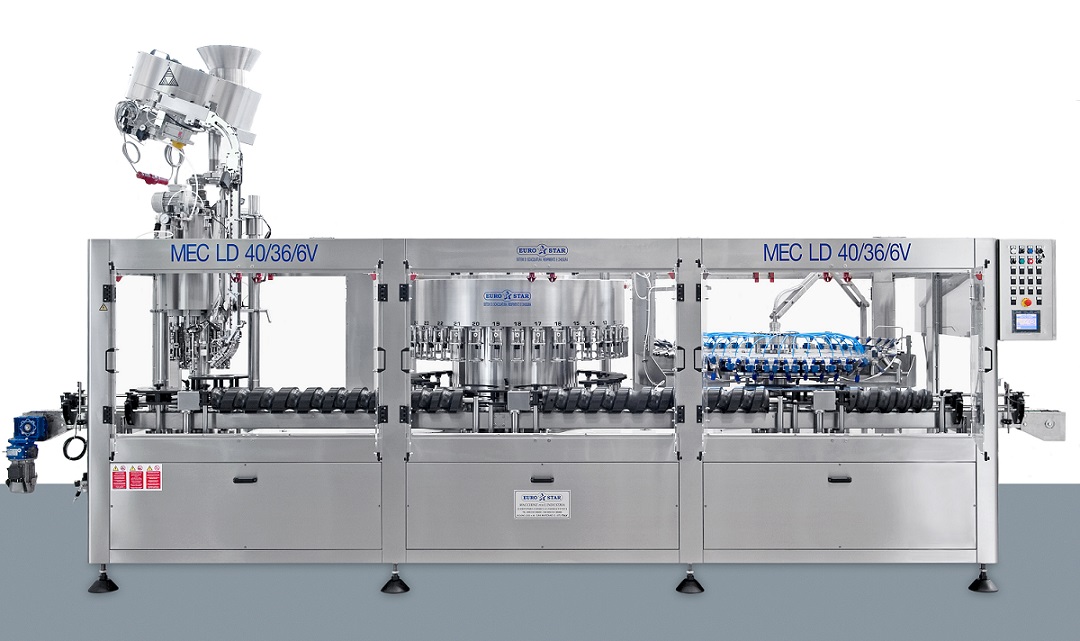

And for Wendy Sharp, at Telford-based Carbonation Techniques that offers Eurostar bottling lines, canning is taking up more of the company’s schedule, but bottling remains important.

“We find an increasing number of breweries choosing canning to complement their bottling output. Very few solely take the bottling route, at the moment. Canning obviously offers a number of benefits over bottling, but they both have their place.”