Global prices for malting barley dried on lack of market activity and any demonstration of demand leads to upward price pressure, explains Adam Darnes, brewing and distilling malt sales manager at Muntons. He also adds that 2023 crop feed values are lower than the 2024 crop given soft demand and well supplied markets following quality downgrades.

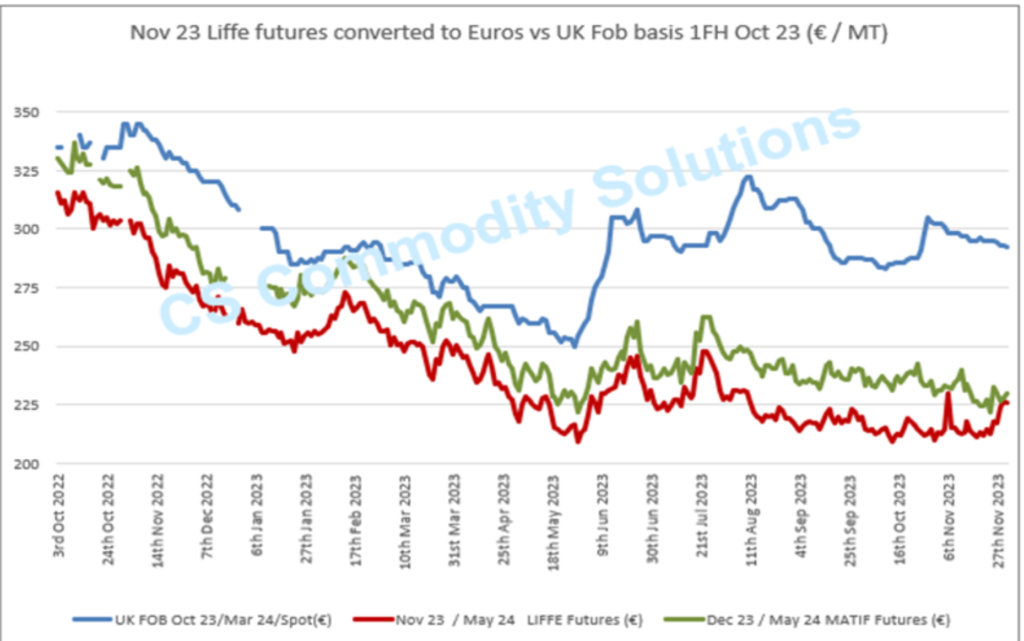

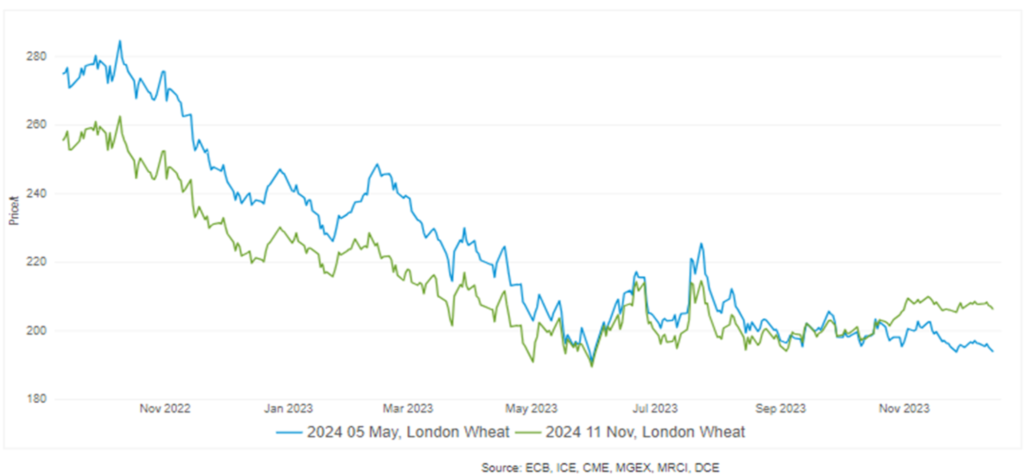

Futures markets edge lower on slack demand, a gap emerges as yield expectations for crop 2024 fall.

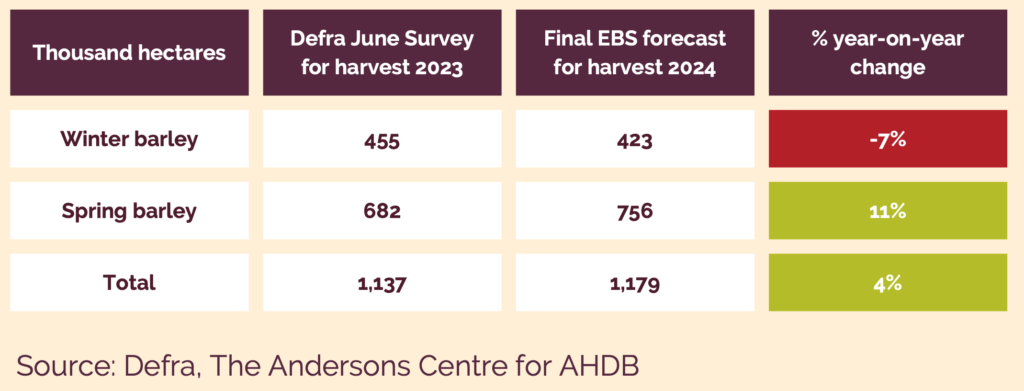

There was 4% year-on-year rise in anticipated barley plantings for 2024 harvest. UK total barley area is expected to grow to 1,179 Kha (4% higher) as higher spring barley plantings intentions outweigh a drop in the winter barley area.

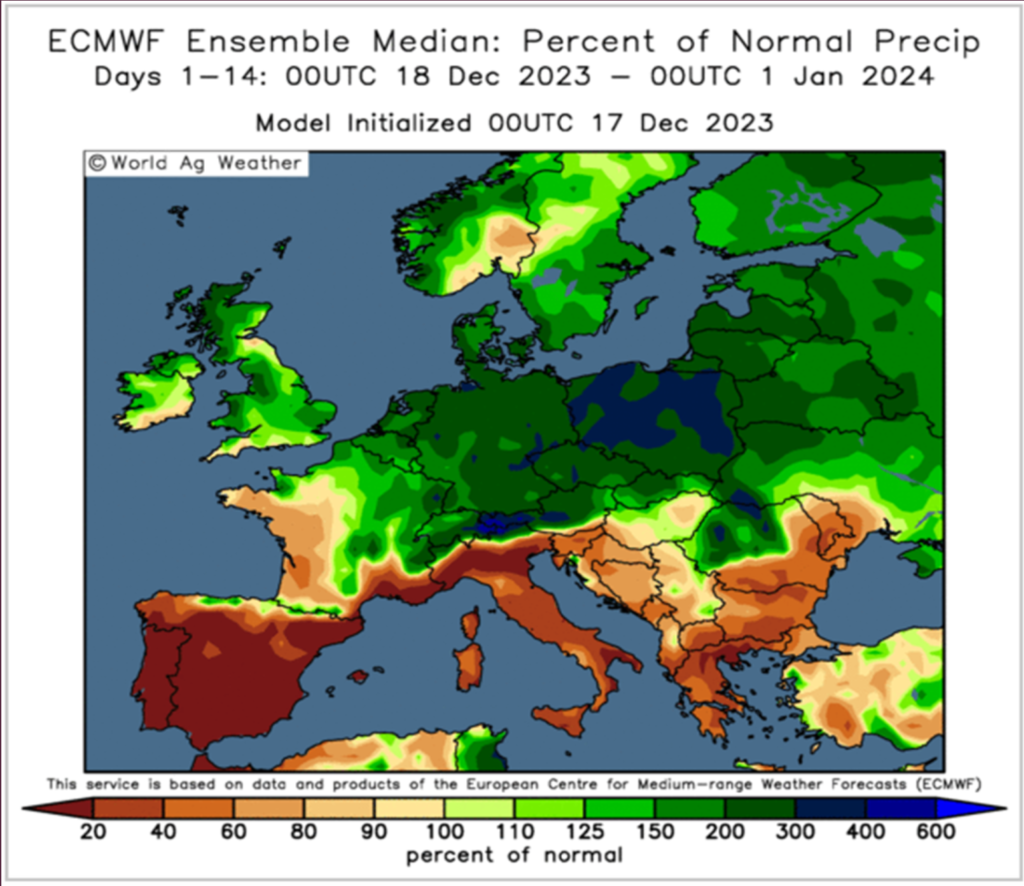

A wet autumn throughout Western Europe is impacting growing crops and planting intentions. Much winter barley has recently turned a yellow colour, because the wet conditions mean barley roots are sitting in water, curtailing their growth.

This is fairly typical of winter barley in winter and most agronomists expect it to pull through. Wet conditions can affect yield if root growth does not restart but for short periods, the discolouration is relatively harmless.

In this condition though, barley will not cope well with persistent waterlogged soil all winter or possible dry conditions in the spring as root structure and biomass will be harmed.

Farmer intention to plant spring crops, in particular barley, have increased. However, this intention is constrained by the availability of seed and the prospect of lower malting barley premiums. The option to give the land a break and prepare for an early entry into crop 2025 is attractive for some growers..

Malting barley markets have softened on low activity. However, strength is visible as soon as demand appears given the overall lack of yield and quality throughout Europe from 2023 crop.