“I want to be different, like everyone I want to be like.”

The lyric, found in US band King Missile’s track ‘It’s Saturday’, was written 25 years ago. But for Alex Troncoso co-founder and head brewer of Bristol’s Lost and Grounded Brewers, it also has a particular relevance to the brewing industry of 2018.

“I think it must be a really fascinating time to be someone like Bart Watson (chief economist at the Brewers Association) at the moment because the way the brewing industry is going, it is like economics playing out in front of our very eyes,” explains Troncoso. “So I felt it was fitting to start with the quote above.

“Wanting to be different, like everyone else, is something of a teenager complex. But when does different stop being truly different?” he asks. “There are thousands of breweries offering a range of similar products so who is different? And are we different because we primarily produce pale lager but then that’s a ridiculous notion because 90-something percent of the beer produced in the world is of that style, so I’m not so sure.”

Troncoso co-founded Lost and Grounded Brewers with partner Annie Clements in the summer of 2016. Although the Bristol outfit only celebrated its first birthday last year, they have already made their name with excellent beers including their flagship Keller Pils.

And head brewer Troncoso’s brewing journey itself is more than 20 years in the making. A home brewer from 1992, he graduated as a Chemical Engineer in 1996 from the Colorado School of Mines, but always dreamed of brewing. Troncoso subsequently completed a graduate degree in brewing as well as a Masters in Business. He played an integral role in the monumental expansion of Little Creatures in Fremantle, Australia, overseeing three production sites, and also served as brewing director at Camden Town Brewery.

“We started Lost and Grounded Brewers in mid-2016 following about a year and a half of planning. We have seven employees, paying them the real Living Wage, and we are primarily known for our Keller Pils that accounts for at least of what we produce,” he explains. “I’ve studied, and have brewing experience, in lots of different countries. Having that perspective makes me agree with John Keeling of Fuller’s, who’ says that a great brewery should having a brewing philosophy. I’ve been fortunate enough to experience that at Little Creatures. That set the tone for me and I hope Lost and Grounded Brewers has that, too.”

In statistics

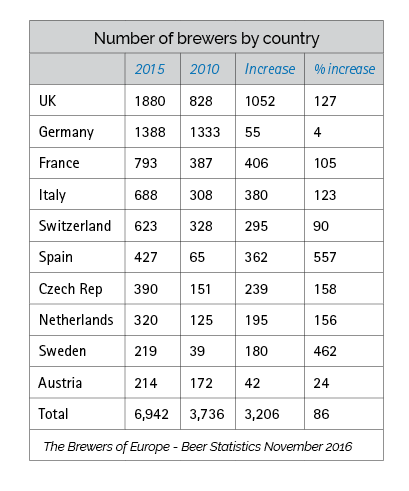

So let’s look at the UK briefly….“The UK is the number two producer of beer in the EU, producing 44 million hectolitres (The Brewers of Europe – Beer Statistics released Nov 2016 using data from 2015). But we’re in a declining beer market with consumption down 4.6%, equal to 2.1HL. That is no small figure, and one that is greater than the output of many small UK producers combined,” he explains. “But the number of breweries in the UK are growing too. In the same period, the figure rose from 828 in 2010 to 1880 in 2015. And that’s higher still, now bringing it closers to 2000.”

Troncoso adds: “But we know things aren’t that straightforward, either. Drinking patterns are changing. People are wanting less, but better. So I think it’s also interesting to look at the figures for Germany in that time. While the UK enjoyed a 127% increase in brewery numbers, the figure only grew 4%, which is hardly any change at all.

Troncoso adds: “But we know things aren’t that straightforward, either. Drinking patterns are changing. People are wanting less, but better. So I think it’s also interesting to look at the figures for Germany in that time. While the UK enjoyed a 127% increase in brewery numbers, the figure only grew 4%, which is hardly any change at all.

“There are a number of reasons for that. You could argue that the barriers to entry are far higher in Germany, and the investment required to get of the ground are more, too.”

So what has happened in the USA?

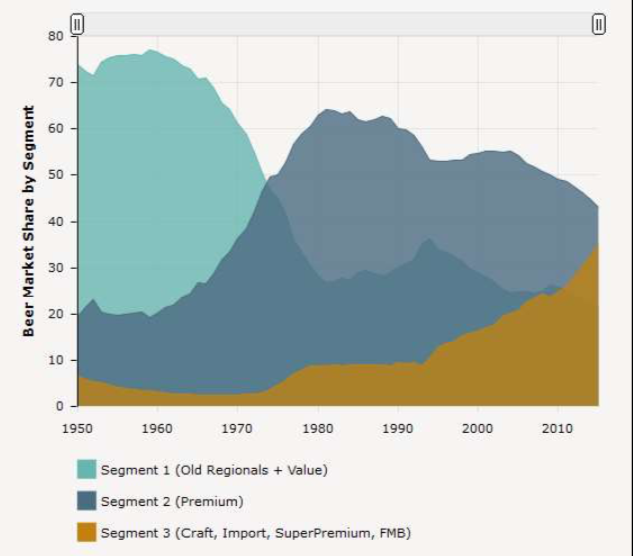

“I find this graph really interesting as it demonstrates the rise and decline of beer categories that have taken place in the US in the last few decades,” he says.

Troncoso points out that the market share of old regionals and value brands fell dramatically from 1950 to the modern day. At the same time, the premium brands start with a 19.4% market share in the 50s and enjoy steady growth to a high of 64.3%, concluding at 43.1% at the end of 2016. Elsewhere, segment three, which comprises craft, import, SuperPremium, Flavoured malt beverages start the graph with 6.5% market share, growing to a high of 35.1%.

He also points out the importance of the quote below.

He also points out the importance of the quote below.

“What the next cycle will bring is anyone’s guess, but brewers who proactively recognize that challenge and focus on what they can control (quality and consistency, for instance) will be better positioned to ride the wave rather than watch it crash over them,” Bart Watson, said in the article ‘Premiumization, pricing and positioning, December 2016).

Troncoso explains that he thinks it’s important that all of of the breweries operating on a small scale and he even includes someone like Fuller’s in that, because they are all “tiny compared to big internationals” and so to operate on a small scale, you need to give people a reason to buy your beer.

“Sure, you might nail the consistency side of things as much as you’d like compared to a bigger brewery with the resources they have, but what we have is the benefit of character and there is a certain beauty in not being quite perfect all of the time,” he says. “ There is a beauty and having that element of change.”

The economics of brewing

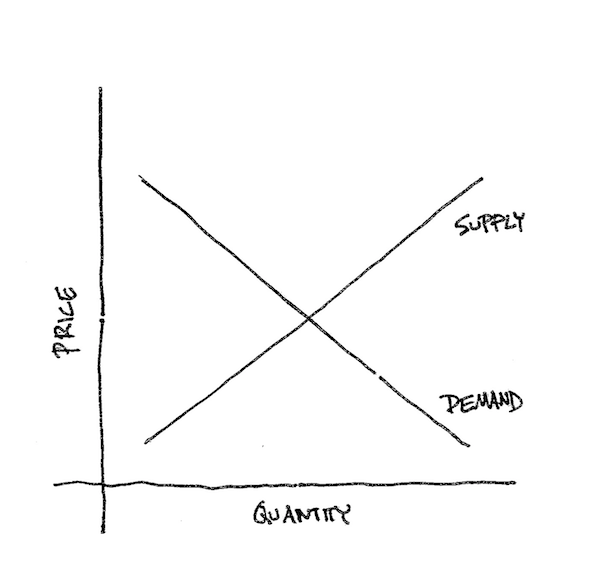

Supply and demand is a fundamental principle in economics and it is fundamentally important to all of us involved in brewing. Using the figure overleaf as a reference, it’s key to remember that in recent years there has maybe a scarcity in that space which helped drive up price a little,” explains Troncoso. ”But as more players enter the market, it’s possible that prices can be forced down, which can present an issue to brewers. We are unable to control what happens as we don’t have the economies of scale that larger breweries can benefit from so once more, you need to focus on what makes you different, what makes you unique, what makes you special.”

He adds: “At the end of the day, the world has enough cover bands, people want some originals. As smaller breweries, we need to be prepared to branch out and do what others aren’t prepared to do. Let’s be honest, starting a brewery in the first place is a blend of ambition and stupidity, with maybe a tiny bit of courage thrown in, too.

“Yes, there are a lot of new players entering the field but I don’t think there is room for more. But the beer has to be good, it has to be considered, it has to be thoughtful. And that can be done in many ways.”

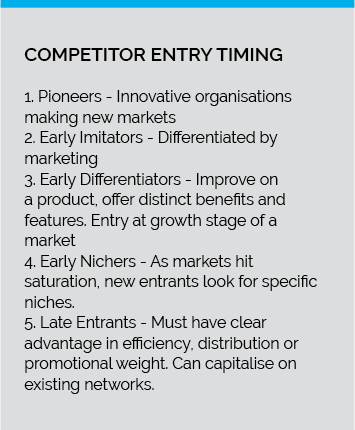

Troncoso explains that we look at how competitors in the market (Principles of Marketing, Brassington and Pettitt, Pearson Education, 2006.) is mirrored in the brewing industry.

“Even though I think a lot of us would like to think that we’re in the ‘Pioneer’ bracket, the reality is that most of us are in the group of ‘Early Differentiators’. So if we’re doing our Keller Pils, then it needs to be the best pale lager we can possibly make. The same if we were doing an IPA,” he says.

Troncoso adds: “If you then look at the ‘Late Entrants’ group. If you’re a brewery that falls into that group, that says to me that you’re likely to be a big brewery. You need to be efficient, have national access, good distribution, and economies of scale to be a success in this bracket. If you’re a small brewery that’s late to the market, then it’s going to be more difficult. You need to have quality, you need to have the lot.”

The acceptable price point of a beer may eventually be dragged down unless it is offset by other forces such as an increase in demand or the positioning of the brand.

“A common path to growth, which is pretty common, is seeking out free listings for your beer. These are commonly found in free of tie lines or those that offer rotational taps,” he says. “There is a lot of us fighting for those so one way of looking at those long term is by offering discounts to the buyer as, let’s be honest, it’s a buyers market. If you need more growth? Then you’re in the position where you have to offer additional discounts, or you have to pay for installations at bars and pubs that will then pour your beers. Finally, the high profile/high volume accounts will require you to pay for listings, provide discounts, and then perhaps offer further volume discounts, too.”

So what is happening in the USA?

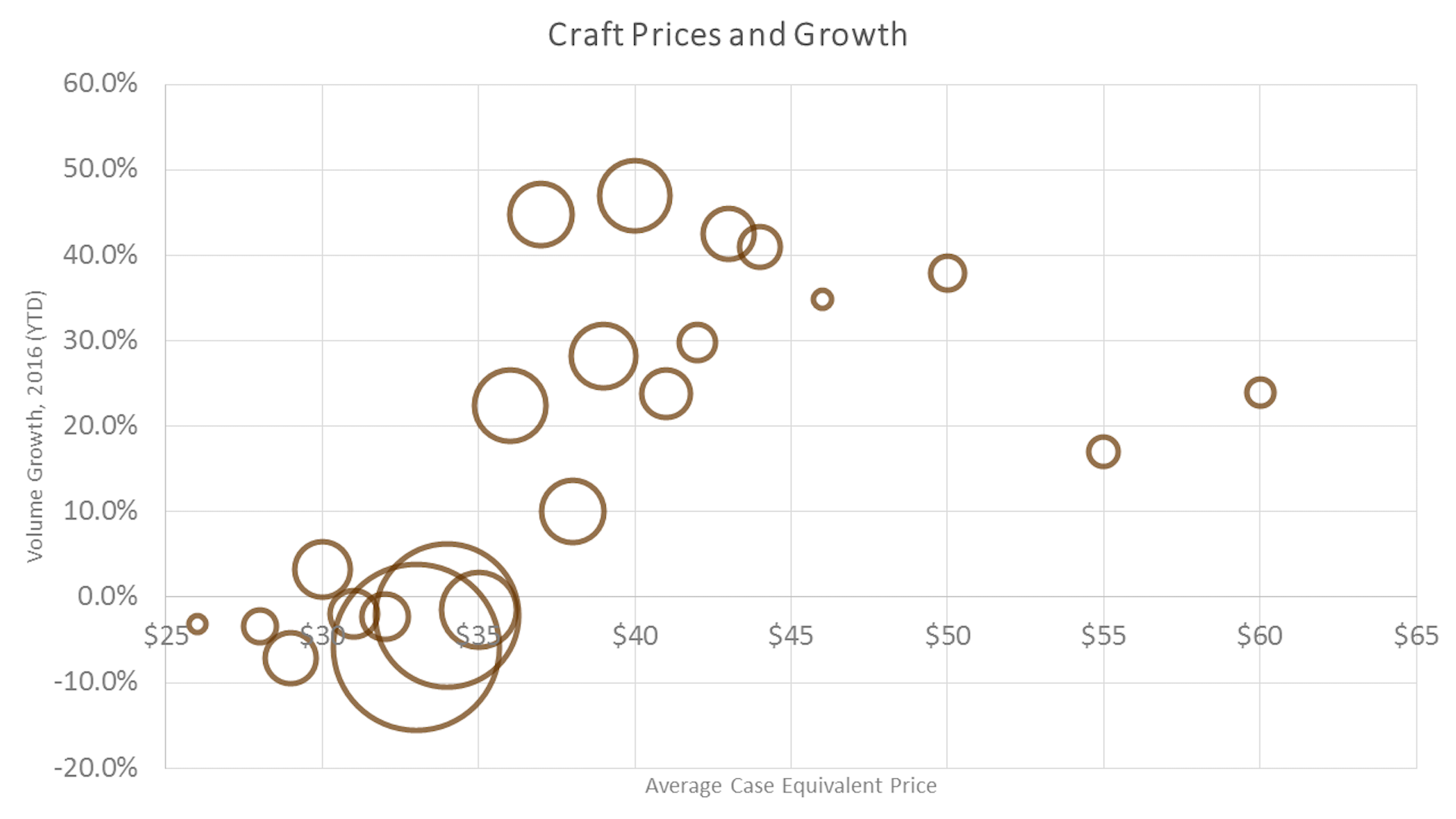

“This is interesting because growth is geared towards the higher end of the average case price. That demonstrates that you can make money from your beer if it’s a quality product and grow at a good rate, too,” says Troncoso. “But quality extends to the bigger picture as well. Quality is how it looks, the taste and the aroma to the way you invoice the customer, how you deal with them, and how you keep them happy. There are many things you must deal with way before the consumer tastes your beer. These all tie into what people consider quality.”

The road ahead

For Troncoso, craft is about assembling a team of people that care about the process from the start to the finish. To make a good product and have everything else flow on from that.

“The industry continues to develop at a great pace with so many breweries opening, so many new beers, so many events… it is crazy! I think there will be a trend towards good lager (ha, of course I would say that!), and increased opportunities for small brewers to enter more into the mainstream as consumers and the trade develops. As that happens, however, I think pressure will increase on pricing as it is really a buyers market,” he says. “The greatest challenge will be to continue gaining distribution to reach our targets – we set up Lost and Grounded Brewers to become a regional brewer, and that takes focus and time. The most exciting opportunity we have now is growing sales: we have a full team, state-of-the-art brewery, excellent wholesalers and quality that is top notch.

He adds: “We will press ahead without distraction and get loads of delicious beer into people’s hands. We also want to see Bristol continue to develop as a beer destination and look forward to working with our fellow brewers to form a united front to put us firmly on the map.

“We are operating in a very crowded market, and conditions require all of us to be as efficient as possible while operating on a small scale. Consideration must be given to all aspects – making good beer is not enough. You need to also focus on culture, marketing, team, branding, sales, distribution and production.”